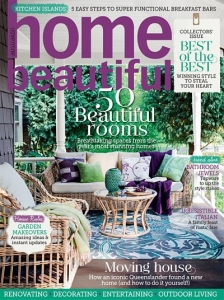

Buying a new home can be one of life’s most stressful things to do as there is so much to consider.

However, it needn’t be stressful if you’re heading in the right direction.

Today I share a few tips to consider if you are buying or moving in the near future.

Inspect Smartly

Oh I do love a staged home and I am the first to admit that I instantly fall in love with a perfectly styled house. I often need to remind myself to be smart and inspect wisely. Think about things like power points, holes in the walls and cracks in the ceilings. Also think about what your furniture would look like in the home and whether the size of the rooms are big enough for your needs. These are just a few things to consider.

.

Monitor The Market

If you want to buy in your local area, monitor the market and watch the prices that houses are selling for. You may have your heart set on a house with a pool and four bedrooms, but it may be that realistically your budget won’t stretch to that. Educate yourself on what you can afford so you are well prepared

Get Your Finances Sorted

When it comes to financing your home, you want the most competitive and comprehensive rate. Did you know that People’s Choice Credit Union were recently named CANSTAR’s 2016 First Home Buyer Customer Owned Institution of the year in– SA? It’s also comforting to know that People’s Choice Credit Union is one of Australia’s largest member owned credit unions. They are also offering a reduced 3 year Fixed Home Loan Package rate of 3.74%p.a* (comparison rate 4.83%p.a) for first home buyers. It’s so important to get your finances sorted, especially if you’re a first home buyer. For more information on how People’s Choice is helping First Home Buyers check out their website.

Talk To The Experts

Talk to the local real estate agents and get first hand knowledge of what is happening in the market. Work with the real estate agents so they can find exactly what you need and within your budget.

Look at Other Suburbs

So, you have your heart set on the beachside leafy suburb that you have always dreamed of living in?. Chances are you may not be able afford your dream location, but have you considered the suburbs that surround it?. Don’t pigeon hole yourself to one area. You may find that the neighbouring suburb is a bit cheaper and you may love it just as much.

I hope these tips have helped you if you are on the about search for your new home. It can definitely be a stressful time, but it really doesn’t have to be if you are well informed and prepared.

Good luck.

[…] times when a lot of people won’t be at home. So if it looks like you aren’t there, it could put your home at more risk of burglary. So the key thing is making your home look like you are home. Here are […]

[…] a person will tell you that beginning to make changes to your new home from the start of your occupancy is a bad idea. They will tell you to rest, adjust to your new […]

[…] hard enough dealing with all the big decisions and stress factors that come with buying a new home. Now that you’ve actually decided to move, you’re going to have to deal with the even more […]