Buying a property can be a great investment for most. It’s something that doesn’t necessarily depreciate, meaning that it should be a solid place to invest your money and time. Of course, things do happen, but the housing market can fluctuate up and down so you never lose out completely. Many people turn to property as their nest egg for the future. They consider buying property alongside pensions and sometimes as an alternative.

Buying a house or a home can be a very daunting prospect, especially if you haven’t entered into the process before. The likes of mortgages, saving for a deposit, the checks that need to be done on yourself as well as the property you have placed an offer on. It can be very overwhelming. However, property can be a big investment for the future and getting over those initial hurdles and considering future plans can be a big option for securing your financial future. If you are thinking about investing in property, make sure that you pick the right type of property for you. Here’s a quick guide to help you make the decision when it comes to property investment and how you can go about it.

Image source – Pixabay – CC0 License

The types of property you could invest in

One of the first things you may want to decide upon is to work out what sort of property you will want to invest in. This could be based on what you think your budget might be, but you also need to take into account where you want to live. It could be you want to live in the city, or maybe you want something a little more out in the country. Perhaps you want to stretch your budget as far as you can, which may mean investing in something that requires a little more effort. However, if you are wanting a little more information about the types of properties that you could invest in then here are some suggestions to help.

A project

If you are not afraid of a little hard work then perhaps a project is right up your street. This means buying a property that is run down and requires some DIY and updating. This can be anything from wiring and electrics to the decoration and plastering of walls. A project can be a great investment as most of the time there is an opportunity to make money rather than just stick with your original amount. A lot of people buy and sell a few of these over a period to increase their capital.

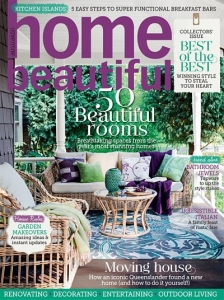

A new home

Maybe you don’t want to do too much DIY work. Then a new home might be the perfect choice for you. This allows you to move into a home that is fresh and new. Requiring very little effort on your part to make it your home. A new build can also be a great investment. Buying off plan when a builder first releases the plots means that when the house is built, you could make money.

Apartment living in the city

It might be that you are thinking more about the location in which you want to live and that could mean that you need a property in the city centre. This could be because you work there and you want an easier commute to work. It also suits younger people and millennials that are wanting to take advantage of city life before retiring to the suburbs or countryside when they settle down. You could look for apartments for sale online easily enough. There may be similar types of properties or you could find that some developments have more unique layouts for apartments or duplexes. It could be a new development where you buy off plan.

Buying abroad

Another option to consider would be buying a property in a different country. This can be an excellent prospect to consider when it comes to thinking about things such as investment. You not only get the long term investment of the value, but you can also take full advantage of things such as short term rental where you could allow it to become a holiday let. The only thing to think about would be the slight changes in the process when it comes to buying in a different country.

Build a house yourself

This option certainly isn’t for the faint-hearted but building your house could be one of the most satisfying and rewarding things you do. Working closely with an architect to design the house you and your family want is quite inspiring. You also have a great opportunity to make money on the property as you source the materials, the higher the labour and keep account of the costs. However, these things can take time and so this isn’t an option if you need to move into your home in a hurry. It can also cost a lot of money if you don’t keep a sharp eye on your finances.

Property to rent out

The last property investment idea would be buying a property to rent out. This is a great option if you don’t need to live in the home yourself. It allows you to invest in the property for the future, but also earn an income on a monthly basis giving you the best of both worlds. If you can manage it yourself, then that is great. However, estate agents offer you the opportunity to pay a little more in a fee and let them handle everything for you. Meaning you can sit back and watch the money roll in. The downside would be that if anything goes wrong in the property, then it is down to you, so make sure you put some money away for unforeseen issues.

Image source – Pixabay – CC0 License

How should you invest?

Once you know the type of property you want to invest in and what sort of budget you may have to make the investment. Now is the time to figure out how you should invest in property and make it happen. Most property purchases will require a mortgage, but there are other elements to consider in order for you to secure the best mortgage deal. With that in mind, here are some of the things to think about to help you with your property purchase.

Speak with mortgage specialists

It might be a good idea at this stage to discuss your requirements with your bank as well as a mortgage broker who can seek out different deals on your behalf. Having the advice of an expert can help you to be more aware of the situation that you find yourself in.

Saving money for a deposit

One of the first things you need to think about would be saving for your mortgage deposit. There are many ways that you can do this. You could set up a regular savings account. This would mean that each month you would transfer a certain amount into a separate account and then add to it as and when you had any spare money. It could be that you earn bonuses through working or have side hustle income that you can save. Building up your deposit is key as most mortgage companies will want at least ten percent for the property purchase cost as a form of deposit for the mortgage.

Making sure your credit history will support a mortgage application

Another thing to think about would be your current credit history and how that is looking right now. The better your credit rating is, the more chance you have of securing a good deal when it comes to your mortgage. Start off by looking at your credit report and ensuring that all information recorded on there is accurate and correct. The next thing to think about would be building up your rating. This might mean paying off credit card debts or consolidating multiple debts into one loan payment. The more you can increase the rating the better chance you have of securing a good deal.

Can you increase your mainstream income?

Your mortgage is also determined a lot on what you currently earn. This is the cinocme of you and any partner who will be taking on the mortgage application with you. You may want to see if there is any way that you can increase your mainstream income. This could be in the form of a pay rise. You could speak with your current employer and see if you are able to apply for an increase in salary. It could mean progressing with your career and finally going for that promotion in the workplace. It might not be a good idea to change employers, as you also need some history with an employer to help with your application, but if you can progress with your current employer this could look favourable. Of course, changing jobs now is a possibility, but you may want to wait six months before applying for a mortgage so that you are out of any uncertainty of job loss or probationary period.

Let’s hope this guide helps you choose the perfect property investment for you.